oregon wbf tax rate

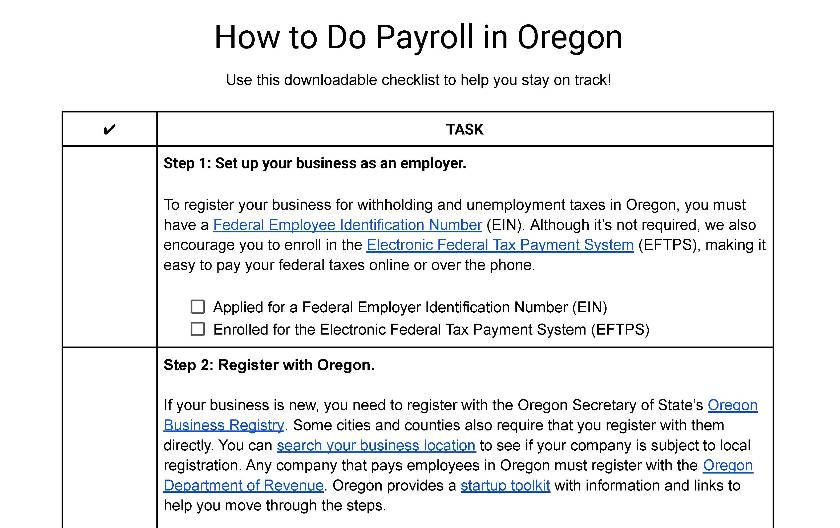

The Edit Employee window opens. 1 2019 Oregons unemployment-taxable wage base is to be 40600 up from 39300 for 2018 the state Employment Department said Nov.

Or Dor Oq Oa 2012 2022 Fill Out Tax Template Online Us Legal Forms

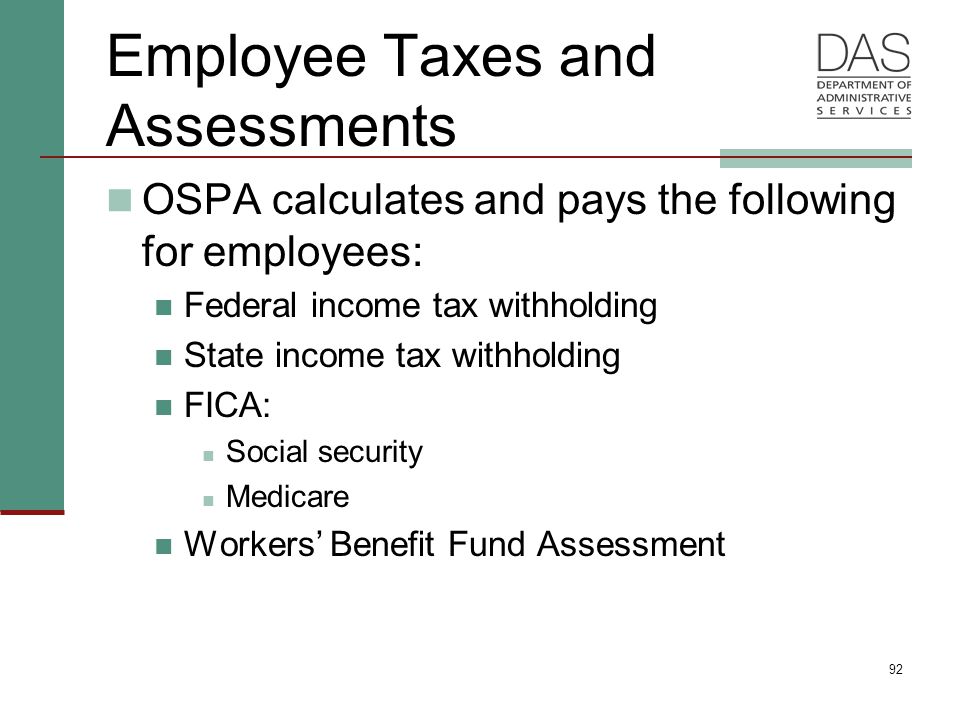

Click the Taxes button to display the Federal State and Other tabs.

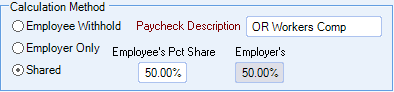

. Designated drop box Tax amount. The Workers Benefit Fund WBF assessment funds return-to-work programs provides increased benefits over time for workers who are permanently and. Workers Benefit Fund WBF Assessment If the flat rate method is used the calculation must be based on 40 hours per week for employees paid weekly or biweekly or 17333 hours per month.

Oregon Workers Benefit Fund. Contents State secure access system. Taxes that provide operating revenue for TriMet are administered and collected by the Oregon Department of Revenue.

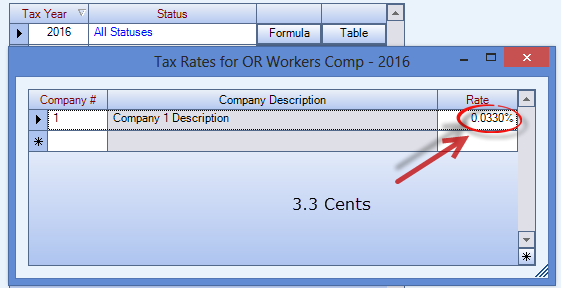

The amount remitted is the cents per hour rate multiplied by the number of employee work hours. What is the Oregon WBF tax rate. The Oregon Workers Benefit Fund WBF assessment is a payroll tax calculated on the number of hours worked by all paid workers owners and officers covered by workers compensation.

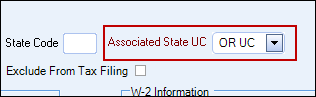

The Oregon Department of Consumer and Business Services has announced that the Workers Benefit Fund WBF assessment is 22 cents per hour worked in 2022 unchanged. Click the Payroll Info tab. Click the Other tab and click the OR WBF tax.

Workers Benefit Fund assessment. The Timekeeping and Employee W-2. The 2022 WBF assessment rate is 022Hr.

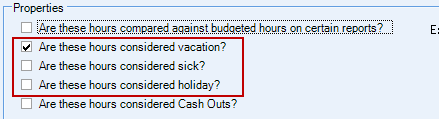

Enter -0 Medical assistance aaicama Annual report 2013 Welcome to the Oregon Secretary of state. QB incorrectly adds vacation hours and holiday hours to calculate this assessment. May 21 2019 358 pm.

The Oregon EITC is 6 of your federal credit with a minimum credit of 24. For proper Oregon tax withholding the Annual Standard Deduction Amount must be entered in the next to last field in each employees record. Low-income Oregon taxpayers may qualify for free legal or tax help though Oregon DOR recognized charities.

Effective January 1 2021. 21 in a news release. The Oregon Department of Consumer and Business Services has announced that the Workers Benefit Fund WBF assessment is 22 cents per hour worked in 2022 unchanged.

What is TriMet tax. Wbf assessment for Oregon is based on the number of hours that an employee works. Employers will need to adjust tax rates accordingly.

The Workers Benefit Fund WBF assessment this is a payroll assessment calculated. The Department of Consumer and Business Services has set the WBF assessment rate for calendar year 2021 at 22 cents per hour.

Oregon Workers Benefit Fund Payroll Tax

Frequently Used Screens In Ospa Oregon Statewide Payroll Services Ppt Download

Oregon Workers Benefit Fund Payroll Tax

Frequently Used Screens In Ospa Oregon Statewide Payroll Services Ppt Download

Oregon Nanny Tax Rules Poppins Payroll Poppins Payroll

Oregon Workers Benefit Fund Payroll Tax

Workers Compensation Market Characteristics Report

Oregon Payroll Tax And Registration Guide Peo Guide

Oregon Domestic Combined Payroll Tax Report Oregon Department Of Revenue Pdf Free Download

How To Do Payroll In Oregon What Employers Need To Know

Oregon Domestic Combined Payroll Tax Report Oregon Department Of Revenue Pdf Free Download

Workers Compensation Market Characteristics Report

Department Of Consumer And Business Services Charts Oregon Workers Compensation Costs State Of Oregon

Oregon Payroll Tax And Registration Guide Peo Guide

Oregon Payroll Tax And Registration Guide Peo Guide

The Complete Guide To Oregon Payroll For Businesses 2022